Webinar Q3 2021 – The Great Escape

VanEck and Bentham collaborate to launch an Australian-first

We’re excited to announce the launch of our first ASX listed ETF (ASX code GCAP) in collaboration with VanEck.

Webinar Q2 2021 – When Will the Herd Be Safe?

Webinar Q1 2021 – When (Bond) Doves Cry

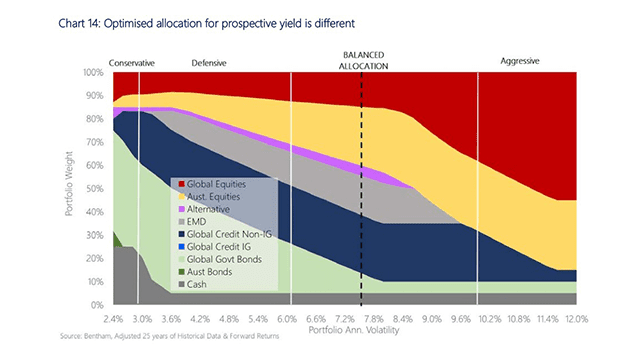

Asset Allocation in a Zero Interest Rate World

The current low level of interest rates provides investors with a very low starting point for forecasting future market returns.

This paper considers the role for alternative asset allocations in a 60/40 balanced portfolio in different economic scenarios over the medium term.

Webinar Q4 2020: 2021 – The Year of the Vaccine

Webinar Q3 2020: After the Pandemic Panic – What Comes Next?

Webinar Q2 2020: Staying Afloat in the Second Pandemic Wave

Missing Asset Class

Australian investors’ portfolios are commonly allocated between two extremes: low-risk cash and fixed interest at one end, and high-risk equities (predominantly Australian equities) at the other, leaving a rather large gap in the middle.

This is unfortunate, because there is an income-producing asset that sits comfortably in that gap. This is The Missing Asset Class.